The Crucial Role of Psychology in Forex Trading 1851102485

The Crucial Role of Psychology in Forex Trading

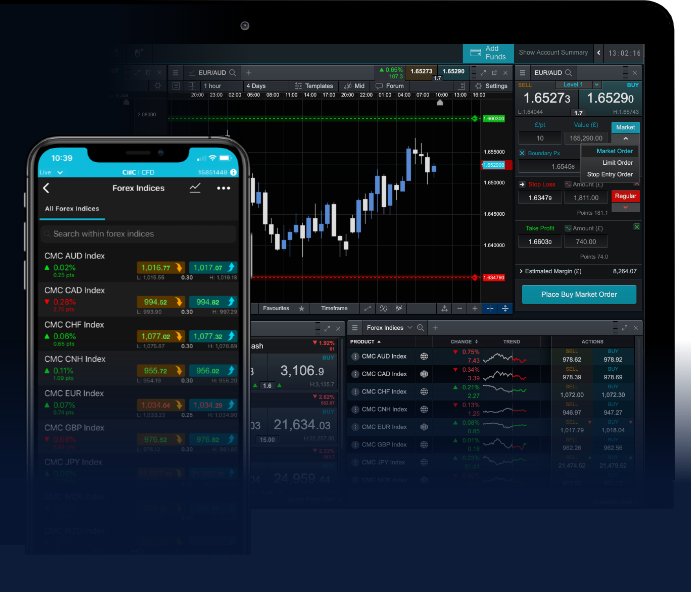

Forex trading is not just about charts, indicators, and market analysis; it’s also significantly about the psychology of the trader. Many new traders might find themselves overwhelmed by the intricacies of market dynamics and the emotional rollercoaster that comes with trading. Understanding the psychological aspects of Forex trading can be the difference between success and failure. For those who are looking to enhance their trading experience, you can check out forex trading psychology Top MT4 Trading Apps to find tools that can aid in your trading journey.

Understanding Trading Psychology

Trading psychology refers to the mental and emotional elements that affect trading decisions. This includes how traders handle losses, successes, and the inherent volatility of the market. Successful trading goes beyond knowing when to enter or exit a position; it involves maintaining discipline, managing emotions, and understanding one’s own psychological triggers.

The Emotional Landscape of Forex Trading

The Forex market is notorious for its rapid fluctuations, which can trigger a wide array of emotions in traders. Fear is one of the most dominant emotions in trading. It can arise from the fear of losing money or missing out on a profitable trade (also known as FOMO – Fear Of Missing Out). On the other hand, euphoria can emerge after a streak of profitable trades, leading traders to take unnecessary risks. Identifying and managing these emotions is crucial for consistent trading performance.

Fear and Greed in Trading

Fear and greed are the two primary emotions that can distort a trader’s judgment. Fear often causes traders to close out positions prematurely, leading to missed opportunities. Conversely, greed can encourage traders to hold onto positions too long, resulting in significant losses when a market reversal occurs. Developing an awareness of these emotions and how they influence trading decisions can help traders maintain objectivity and make rational choices based on market data rather than emotional responses.

Building a Trading Plan

A well-structured trading plan is essential for managing the psychological aspects of trading. This plan should outline specific strategies, including entry and exit points, risk management rules, and evaluation criteria. Having a plan helps to minimize emotional decision-making. Traders who stick to their plans are less likely to be swayed by market emotions and can better withstand the psychological pressure that comes with the volatility of the Forex market.

The Importance of Discipline

Discipline is a vital element in successful trading psychology. It refers to the ability to adhere to a trading plan and follow predetermined rules, even when emotions run high. Disciplined traders are more likely to apply consistent risk management strategies and to avoid making impulsive decisions based on fear or greed. Developing discipline requires practice and can be reinforced by setting realistic trading goals and regularly reviewing trading performance.

Overcoming Psychological Barriers

Many traders face psychological barriers that can impede their performance. These can include issues such as a fear of failure, fear of missing out, or overconfidence after a series of wins. Recognizing these barriers is the first step in overcoming them. Traders can work through these issues by employing techniques such as journaling their trades, practicing mindfulness, or seeking mentorship or support from more experienced traders.

The Role of Self-Reflection

Self-reflection is a powerful tool in identifying and addressing psychological obstacles. By maintaining a trading journal, traders can document their emotional states, the strategies employed, and the outcomes of their trades. This practice allows traders to analyze patterns in their behavior and emotional responses, thereby increasing awareness and improving future decision-making. Self-reflection can lead to more informed and rational trading choices.

Emotional Regulation Techniques

Incorporating emotional regulation techniques into one’s trading routine can significantly enhance performance. Techniques such as deep breathing, visualization, and cognitive restructuring can help traders manage their emotions effectively. Deep breathing exercises can reduce anxiety during high-stress trading periods, while visualization techniques can prepare traders mentally for various market scenarios. Cognitive restructuring involves challenging and reframing negative thought patterns that may lead to harmful trading behaviors.

Creating a Supportive Trading Environment

Establishing a supportive trading environment is another strategy to bolster psychological resilience. This can include creating a physical space that is conducive to concentration and minimizing distractions. Additionally, surrounding oneself with supportive peers or mentors can provide encouragement and constructive feedback, which can help traders navigate emotional challenges more effectively.

The Long-Term Perspective

Successful Forex trading is a marathon, not a sprint. Embracing a long-term perspective can help traders overcome short-term emotional fluctuations. Instead of obsessing over day-to-day movements, focusing on overall performance and strategy refinement can promote better emotional stability. This long-term outlook encourages patience and discipline, which are crucial for sustainable trading success.

Continuous Learning and Adaptation

Finance and markets constantly evolve, and so should traders. Engaging in continuous learning about both market trends and the psychological aspects of trading is essential. This can be achieved through education, attending seminars, reading books, or even participating in online forums. Adapting to new information and adjusting strategies in response to market changes can instill confidence and reduce anxiety levels.

Conclusion

Forex trading psychology plays a fundamental role in achieving success in the volatile and unpredictable world of currency trading. Recognizing the impact of emotions such as fear and greed, as well as employing strategies to maintain discipline and self-awareness, are essential components of a successful trading journey. By focusing on these psychological aspects, traders can enhance their performance, minimize losses, and ultimately achieve their financial goals. Embrace the mental side of trading and watch as your trading skills and performance improve significantly.